Have you ever had a conversation with a colleague, mate or even your neighbour, only to hear that they’ve found a better loan rate than you?

Inconsistency in loan rates in agriculture is something we regularly see. At Sprout Agribusiness, we’re in a unique and fortunate position to be tendering out loans on a regular basis, so we have a sound understanding of where pricing should be. As a general rule, there are three factors that hold significant influence on a bank’s pricing.

- Pricing that is driven by the cost of funding, that is driven by each bank’s exposure and reliance on deposits, wholesale funding and other funding requirements.

- Rates set by the RBA

- Risk to the bank, and the probability of default, acknowledging that everyone is on a different risk margin.

While securing a competitive price is a desirable outcome for anyone seeking a new loan for a farming business, it’s crucial to ensure that the bank you choose and the structure of your facility are aligned with your future growth.

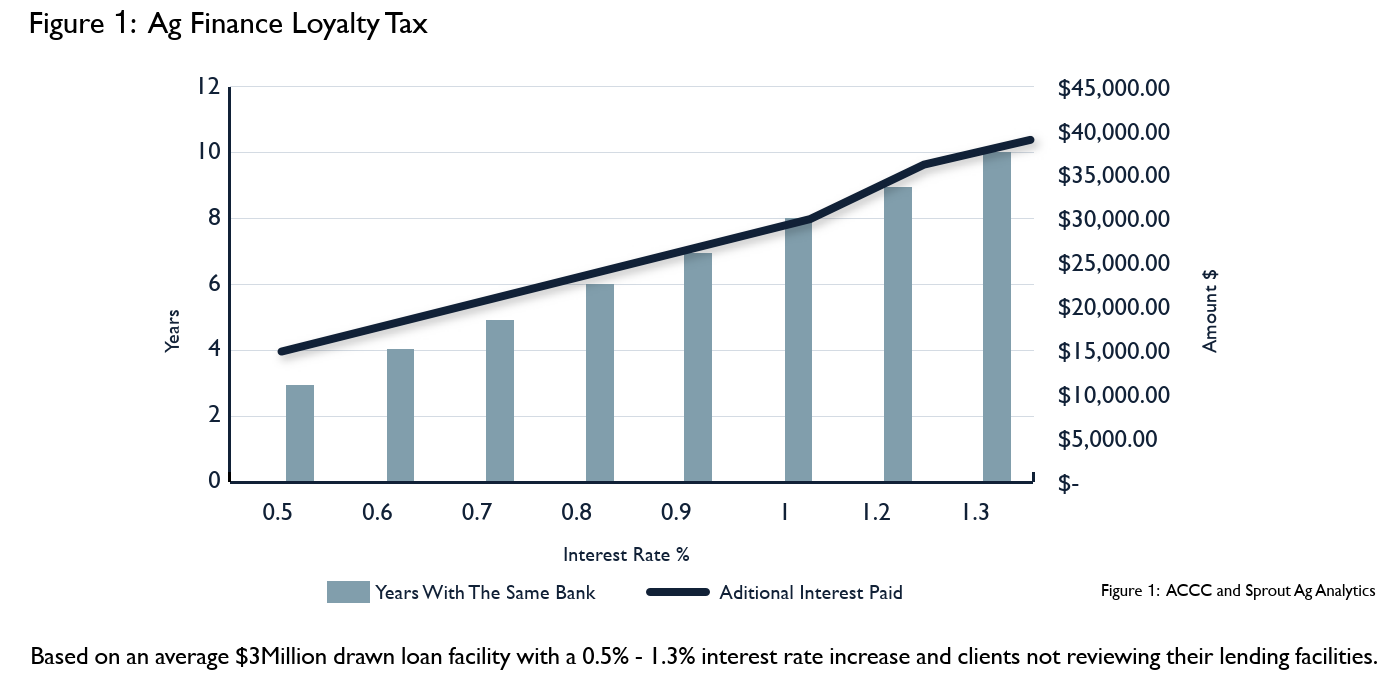

At SproutAg, we believe it’s essential to evaluate your pricing options to ensure your loyalty to your bank isn’t costing you money. When providing clients with a rate, banks add a risk margin to the base rate, which influences what you pay. Our Bank Loyalty Tax Graph is an estimate of the price of loyalty to your bank.

Inconsistency in rates also stems further than the three key factors, it also boils down to individual bank managers, and how they’re tracking against their budgets. A manager’s targets, profit and loss or revenue can all affect the rate you’re quoted. As an example, we can have the same client with the same risk grade looking at a 1.5% difference between individual branches within the same bank.

Top tips for how you get the best rate:

- Be organised and properly tender out your business. Don’t just ask your existing bank for a rate reduction.

- Tender out your banking at least every three years.

- Prepare and provide the best information possible. To do this, make sure you check out our Finance Ready Check List.

By making the time and effort to get your banking right, you might just see your best pay day yet!